talk to an expert

We're ready to help

Our ProCorp experts can answer your questions and provide a free assessment.

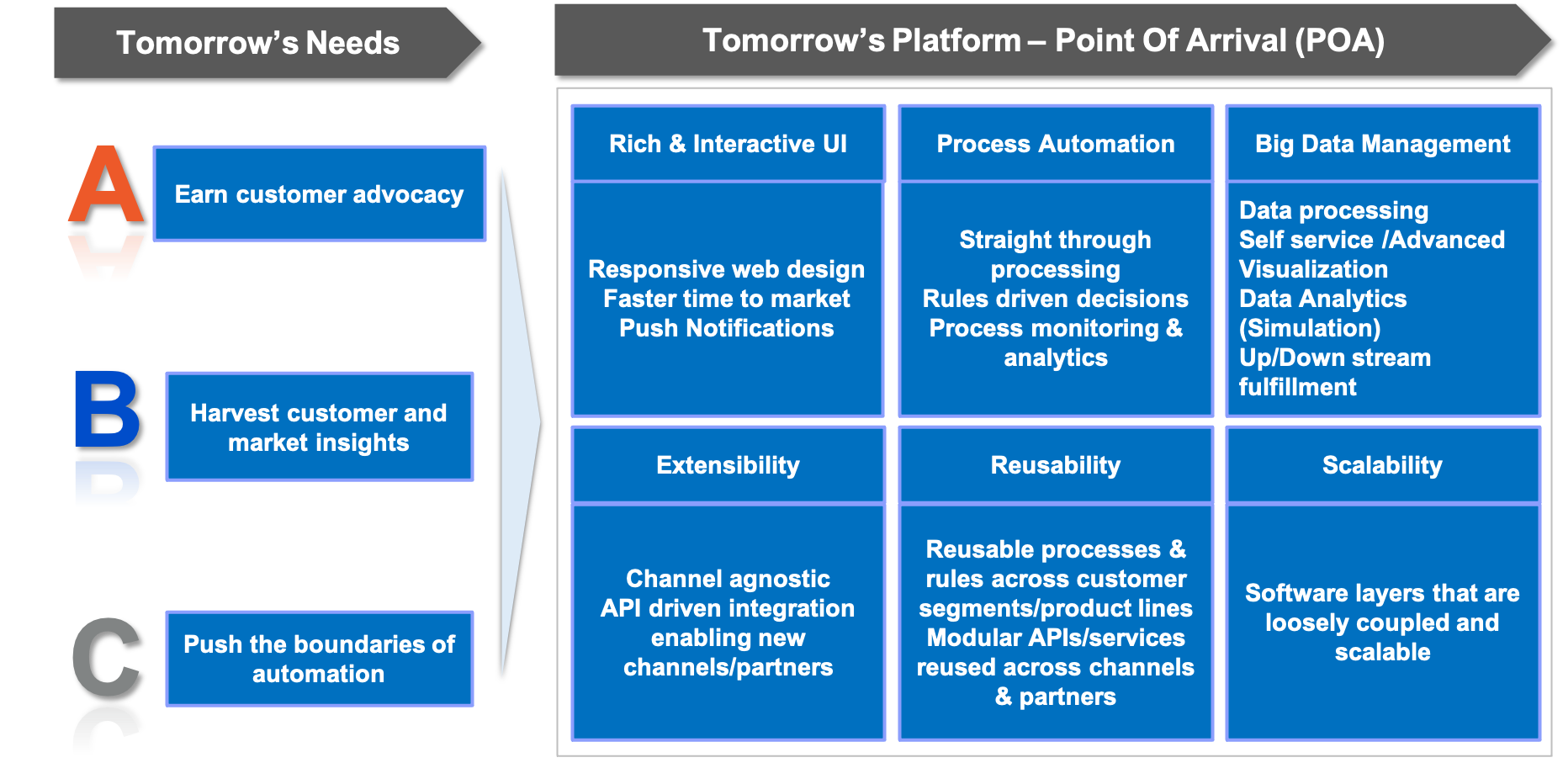

Enterprises today operate in the age of the digital customer where they must deal with an ever-changing set of expectations. It demands companies to build and provide engaging customer experiences. No matter your industry, you've either learned this, or soon will: the era of monolithic service architectures is over. As the need for a nimbler enterprise takes priority, organizations of all types are switching to microservices. A microservices architecture can offer a more scalable, resilient, secure enterprise — all while streamlining the process and time it takes to build and ship working improvements to any application.

often struggle to develop successful application modernization business cases, especially across multiple platforms. Those who succeed take a business-focused approach, chunking the work to target the most critical business capabilities, and delivering in multiple waves."

Application leaders often find it challenging to create a modernization business case that convinces management – especially business stakeholders – to invest, with case weakness often stemming from taking an IT-centric approach.

Application groups allow modernized applications to languish without continual fit-for-purpose review, treating modernization as a one-time event rather than an ongoing practice. The key to winning the age of the digital customer lies in improving speed and agility. It is challenging to scale Monolithic architecture and hence does not lend itself to agile deployments.

Microservices help overcome these shortcomings of monolithic architecture and provide a solution that helps systems and applications be as modular as possible. It comes with a pre-integrated eco-system with architectural reference tools that ensure best practices for NFR’s (Non-Functional Requirements) like logging, monitoring, discovery, security. Microservices reference architecture results in a system that is scalable, agile, and flexible. With our Microservices and API solutions, companies can iterate quickly, simplify deployment, and shorten the time-to-market.

ProCorp’s Microservices Reference Architecture defines ownership boundaries to each system component and provides the ability to adopt any framework for different parts. It aims to increase agility by decoupling system components and reducing the cost of application scaling. By creating a reference architecture, we have mastered the art of achieving the transformation from monoliths to microservices.

The API economy refers to the set of business models and practices designed around the use of APIs in today's digital economy. It involves the exposure of an organization's digital services and assets through application programming interfaces (APIs) in a controlled way.

Applications and their underlying data are long-established cornerstones of many organizations. All too often, however, they have been the territory of internal R&D and IT departments. From the earliest days of computing, systems have had to talk to each other to share information across physical and logical boundaries and solve for the interdependencies inherent in many business scenarios. The trend toward integration has been steadily accelerating over the years. It is driven by increasingly sophisticated ecosystems and business processes that are supported by complex interactions across multiple endpoints in custom software, in-house packaged applications, and third-party services (cloud or otherwise).

The growth of APIs stems from an elementary need: a better way to encapsulate and share information and enable transaction processing between elements in the solution stack. Unfortunately, APIs have often been treated as tactical assets until relatively recently. APIs, their offspring of EDI and fuel the new API economy.

Learn More

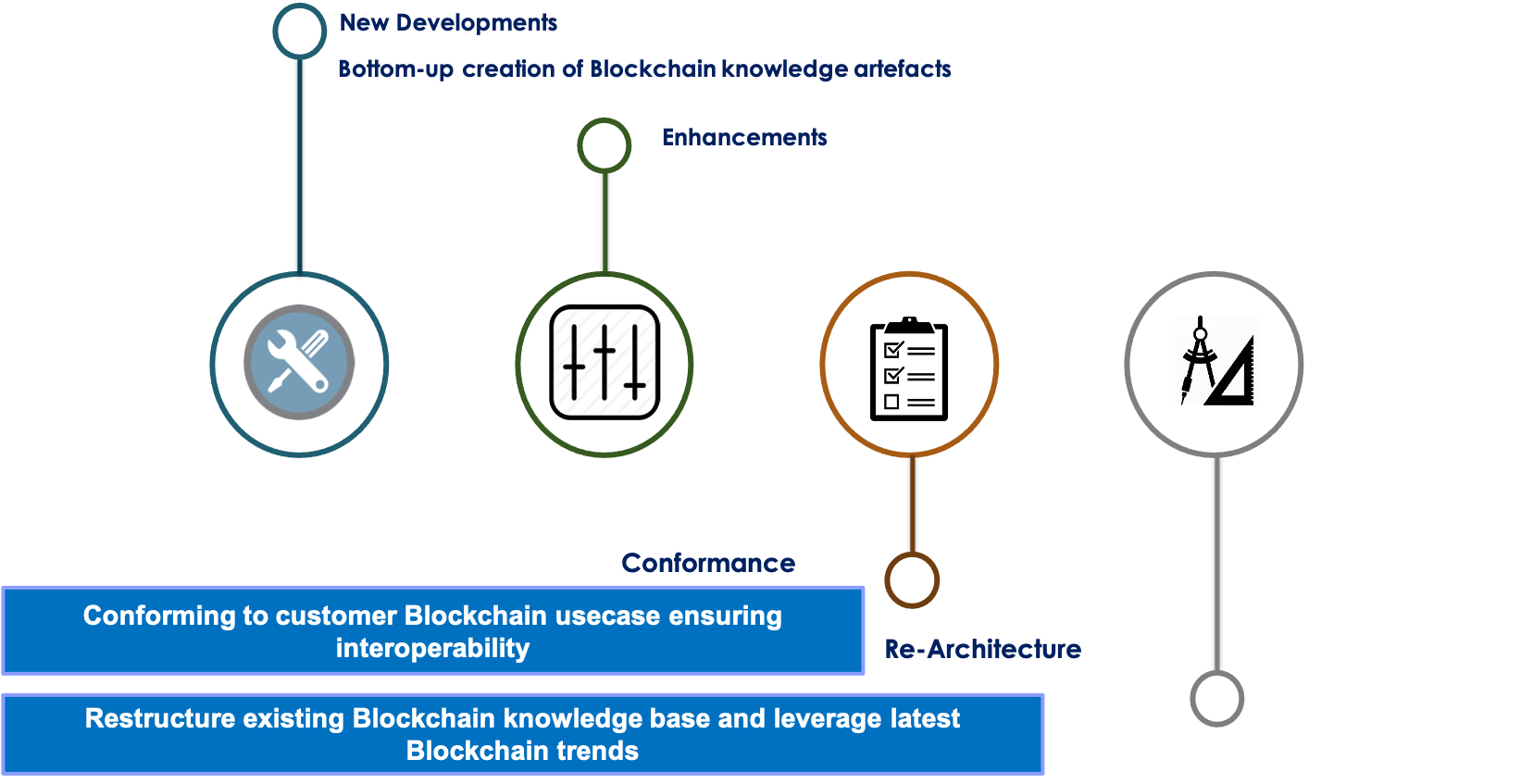

Blockchain technology offers a way for market participants to access dematerialized assets directly without always going through other participants needlessly

Centralized Repository (today’s system): most participants are disconnected from their asset depository, settling transaction would require participants to collaborate in a flow that is slow, inefficient, and expensive

Shared Repository: all participants can interact with depository directly without going involving third parties, potentially making post trade operations cheaper and faster

Trading, clearing, and settlement functions can all be automated on a blockchain network using smart contracts and oracles.

New technologies and business models are redefining bank operating models and how banks interact with customers. Although once a leading technology adopter, banking now lags other industries in terms of digital transformation.

Traditional banks need to modernize to offer a relevant, engaging real-time customer experience and to fend off challengers. New banks need the benefits of modern design, personalized products and services, low fees, and snappy customer service to tempt people in. All banks need to choose their technology providers and advisors carefully to ensure their modernization journey is a success.

Customers are restive, with high expectations that are increasingly set by their experiences outside of financial services. Many banks are evaluating how they can gain the agility and flexibility they need to meet rising customer expectations

The global cards and payments industry is witnessing a diminishing trend in traditional banking and constantly progressing towards emerging digital technologies. To keep up with the trend, financial institutions are adopting to new technologies and complying with constantly changing regulations / compliances. Looking ahead, we must adapt – providing solutions that solve customer challenges when and where needed. Our offerings are designed to be frictionless, be automated, and promote growth beyond to radically transform the way we operate to drive global standardization and scalability.

Cards & Payments business is one such segment within the financial services industry which exemplifies this business trend. As digital commerce grows more rapidly, both the incumbents and challengers must find ways to reduce friction in payments and improve security to win in the marketplace. Digitization in payments will continue to make it ubiquitous and embedded but it is equally important to make it more secure as well.

ProCorp has rich experience in handling complex and diverse platforms across every aspect of Cards & Payments value chain covering card networks, card processors, merchant acquirers, payments service providers

Learn More